So you have a family member who you think will be attending college at a later point in time and you have money available to save for their future. What are your options?

This is a common question we get at Scope Wealth Management and throughout this series we will be focusing on some of the common education savings vehicles that provide tax advantages while helping you meet your education related goals. Today’s topic will be a brief overview of the most common option – 529 Plans; if you have specific needs or questions please feel free to contact us for more information.

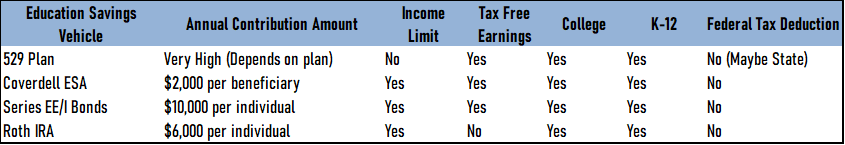

Here is a list of popular education savings vehicles. However, this article will focus on the most common, the 529 plan.

529 Plans

529 Plans are named after Section 529 of the Internal Revenue Code and were created by Congress in 1996. At a high level, the 529 Plan is considered an asset of the parent and allows an individual to set aside after tax funds into an investment account whereby the account grows over time. The program, or investment account, is set up through a state or educational institution. Any growth of the account is tax free when used for qualified education expenses of the account beneficiary. You can see why some may think of the 529 Plan as a sort of educational Roth IRA. It certainly contains several similarities but let’s break down the details of how 529 Plans work and how to get started with one.

As I mentioned above, 529 Plans can be set up through states or by some educational institutions like colleges and universities. All states have at least one state-sponsored savings plan and some colleges/universities offer their plan as a prepayment type system (at today’s prices and cost.) Someone who sets up a 529 Plan is not constrained to their own state’s plan and the proceeds can be used for an out of state educational institution. For example, if you live in Colorado you can set up a 529 Plan in Ohio and can withdraw those funds to pay for educational expenses in Oregon. Each state’s plan contains various investment options offered by the plan sponsor.

If an individual were to set up a 529 Plan, they would be considered the custodian of the account and have ultimate control of the funds until they are withdrawn. The owner of the account sets up a single beneficiary of the account – typically the future or current student – for whom the plan is meant to benefit.

Image from https://www.collegesavings.org/

No federal tax deduction is allowed for contributions into the plan, but currently around 30 states offer a state tax deduction for those who live in state and contribute to that state’s plan. The primary benefit of the 529 Plan is the potential for tax free growth of the plans assets when distributions are used for qualified educational expenses. What that essentially means is that as long as the withdrawals do not exceed the educational expenses, both the account contributions and appreciation are tax free.

More specifically, educational expenses include the following:

Contributions

An individual can contribute up to $75,000 in a single year without gift tax consequences. This utilizes 5 year gift tax averaging (or 5 x $15,000) and a couple could double this amount if desired. However, the general contribution strategy should be to provide enough funding for the beneficiary’s education costs but not exceed the costs - due to the potential of penalties and taxable income.

Funds withdrawn from a 529 Plan that are not considered qualified distributions used for educational expenses are subject to federal taxation and a 10% penalty. It is important to note that this only applies to the appreciation in the account and not your contributions – those are yours to keep without penalty since you have already been taxed on those dollars. While there are several circumstances that could avoid this taxation, it extends beyond the scope of this article and can be discussed individually to clients.

If you happen to overfund or the beneficiary decides not to go to college, there are a few options available to you to avoid taxation and penalties. First, you could simply change the beneficiary of the account to another child/grandchild/even yourself. Also, funds in a 529 Plan can be used towards K-12, private, public, or religious schools. They can also be applied towards educational costs of accredited post-secondary or vocational schools.

The Bottom Line

529 Plans are tax advantaged vehicles designed to assist families pay for future expenses associated with college, graduate school and - as of January 1, 2018 – K-12 education. They also provide tax advantages if used properly which help offset the rising costs of tuition and fees. The 529 Plan is by far the most common education savings vehicle used today to assist families reach their education goals; but their main strength is through the tax savings of investment gains. Since the real benefit is through tax-free withdrawals of earnings built over time, it behooves one to start them earlier in the child’s life to maximize the tax savings. We will delve into other options going forward but in the meantime I hope you found this piece helpful. If you have any questions please do not hesitate to contact us to schedule a consultation.

Scope Wealth Management does not participate in managing 529 Plans - 529 Plans are state sponsored - however, we recommend various investment vehicles based on specific needs and suitability for each client.